A recent study by the Urban Institute and the

Consumer Credit Research Institute looks at debt delinquency in the United

States. Before we delve into the contents of this study, let's look at

how much commercial bank consumer debt there is out there according to

FRED:

According to the Federal

Reserve Bank of St. Louis, there is a total of $1.17 trillion in consumer loans

outstanding at America's commercial banks. At the beginning of the Great

Recession, there was "only" $798.1 billion in consumer debt in

December 2007. This means that consumer debt to the commercial banks

alone has risen by $372 million or 46.6 percent in less than seven years.

If we look at total consumer debt including housing and

non-housing debt, this is what we find:

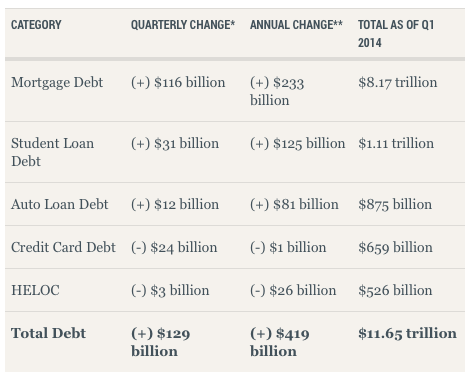

In the first quarter of

2014, total household debt was $11.65 trillion; $8.69 trillion of which was

housing debt and $2.96 trillion of which was non-housing debt. Here is a chart showing the

quarter-over-quarter and year-over-year changes by debt category for Q1 2014:

We should also bear this graph in mind:

While consumer confidence

has improved since the depths of the Great Recession, it is still below its

historical inter-recessional levels, particularly if one looks back to the

period between 1995 and 2000.

Now, back to the study.

The authors open by

noting that their study used data from TransUnion to measure the number of

Americans that are at least 30 days late on a non-mortgage payment. This

data represents only Americans with credit files and does not include the 22

million American adults that have no credit file. In general, these

non-represented people tend to be low-income and cannot access credit meaning

that they generally do not have overdue debt.

Here is a map of the

United States, with the census tracts coloured according to the percentage of

adults that have debt that is past due with the darker blue colours

representing a higher percentage:

On average in the United

States, 5.3 percent of adults have credit that is past due.

Now, let's switch gears for a moment and look at how many Americans have debt that is in collections. A shocking

35.1 percent or 77 million Americans have debt that is currently in collections

and the average amount of debt being collected is $5178. Interestingly,

the average household income for debtors that are past due is $72,274, well

above the median household income with four family members of $67,457 in 2013.

The areas with the

highest share of past due debt and debt in collections are found in the South,

particularly the East South Central and West South Central parts of the United

States as you can see with the concentration of darker blue colours on the

previous map. In the East South Central region, 6 percent of people have

debt that is past due and 41.3 percent have debt that is in collections.

In the West South Central region, 7.5 percent of people have debt that is

past due and 43.6 percent have debt that is in collections. Around 40

percent of the census tracts with the highest concentration of debt that is

past due are found in Louisiana and Texas.

Of the states, Nevada has

the highest percentage of people with debt in collections at 47 percent.

The District of Columbia (41.8 percent), Alabama (41.7 percent), Arkansas

(40.2 percent), Florida (41 percent), Georgia (42 percent), Kentucky (41.9

percent), Louisiana (43.8 percent), Mississippi (44.7 percent), New Mexico

(40.8 percent), North Carolina (40.3 percent), South Carolina (46.2 percent),

Texas (44.7 percent) and West Virginia (41.5 percent) all have more than 40

percent of their people with debt collections.

The states with the

lowest percentage of people with debt in collections are Hawaii (22.7 percent),

Massachusetts (23 percent), Minnesota (19.8 percent), Nebraska (23.9 percent),

North Dakota (19.2 percent), South Dakota (20.8 percent) and Vermont (23.7

percent).

If we look at the amount

in collections, Nevada comes in first with $7198 followed Wyoming at $6803,

Alaska at $6443, Florida at $6396 and Arizona at $6224.

What I found interesting

about the study was that there was a tenuous relationship between debt problems

and income level. While areas with lower household income tend to have

more people with debt that is past due, the mathematical correlation of

-0.3 suggests that there is more to debt problems than income levels.

The danger of debt in

collections cannot be understated. Debt in collections is a result of

failing to make a payment on an outstanding bill which can include medical

bills, credit card bills or utility bills among others. This problem can

haunt consumers for many years, impacting their ability to get credit in the

future and their ability to "get ahead". The high number of Americans with delinquent debt suggests that the

financial distress being experienced by many families since the "end"

of the Great Recession is far from over. To at least some extent, we have

the Federal Reserve's easy money policies to thank for making credit appear to

be the cheapest it has ever been. America's consumer debt problems may also go a long way to explaining why consumer sentiment is still well below historical levels. In our consumer-driven economy, this negative sentiment is reflected in the very modest growth levels of the economy as a whole.

The posted 2nd Qrt for GDP is currently 4%.... But im not suprised about the in collection numbers. I'm in collections for medical bills and its not even that much money its just small amounts that when added together create a large enough bill that when living paycheck to paycheck can't be paid off right away.

ReplyDeleteFrom what I've read, a substantial portion of Q2 growth was in inventories which contributed 1.66 percentage points.

ReplyDeleteThanks for another great article. I'm still pondering the role of bad debt and broken promises in our society. It is huge and very real. A great deal of our economic system is about debt. It is important to remember not all debt is created equal. A mirage is a naturally occurring optical phenomenon in which light rays are bent to produce a displaced image of distant objects. Joining the idea of a mirage and contagion with the reality of collapsing debt forms an interesting subject.

ReplyDeleteIt is important to remember all debts and obligations do not come due at the same time. Also, it must be noted when a bill is not paid or defaults it often starts a long and drawn out legal battle, this collection process that may extend years without harsh consequences. This my friends is the reality of modern life in America and much of the world. More on this subject in the article below.

http://brucewilds.blogspot.com/2014/05/debt-mirage-always-moving-into-di...